[Update: I have updated that part on the last 5% downpayment after clarifying]

Following my last article, I went on to consider my housing options.

In

terms of HDB, there were 4 new MOP projects available but I couldn’t get over

the fact that I would have to negotiate the price, secure the OTP before

doing the Fengshui review.

I could shortlist the units first, do the fengshui review. Then proceed with

the viewing and negotiations, but the house might not be available

anymore.

So

what did I just spend money for?

My next options which were completed Condos near my house around

the Geylang Lorong 30 – 40 and Tanjong Katong Road. They were mostly freehold

and affordable.

The

only issue is that I'm not ready to commit everything now. The other issue was

that the development size was normally quite small implying a lack of transactions on price clarity and higher

maintenance fee.

This

brought me to the last option, which was to look at new launches. As I don’t really have the time and energy to

go understand a new area, I was surprised to find 3 new

launches near me:

- The Continuum – Freehold

- Dunman Grand – 99yr

- Tembusu Grand – 99yr

Since

there are projects available should I commit to a new launch?

The three-way fight in D15

Looking

back, these are my requirements:

- Somewhere I’m familiar with i.e. near my home

- Accessible but not too close to MRTs so that the neighbourhood is quiet.

- Available to buy now

- It’s for investment in the near–mid term but I would like to move over once my estate needs renewal.

- Within my financial capability

- Lowest interest rate quantum in the near term until my financial situation stabilises.

- Fengshui Layout that is optimised for me.

All

3 projects were within my area, and I am able to visualise them.

I

didn’t like Tembusu Grand at all. I used to take the bus to school and the

roads aren’t exactly wide enough.

Hence, it can get quite congested during the morning rush with the schools and all. Sure the new MRT line will make life easier,

but the key priority to me is its accessibility to Paya Lebar MRT.

Next

was Grand Dunman, which is extremely popular. Given its proximity to

Dakota MRT, it’s almost a no-brainer. Not only that, you get the following:

- Old airport road food centre

- Unblocked view of the “river/canal” – my generation will remember

it as the stinky long kang (drain).

- Park connector to MBS

- Near the schools

- Direct access to the national stadium.

- Reassurance from the performance of Waterbank at Dakota

My

nit-picks would be that:

- Priced pretty high as it has so many selling points

- Not a freehold but I wouldn’t expect a 20% discount from The

Continuum either.

- No direct bus from my house to Grand Dunman, I need to

either switch buses or bus à train.

- No direct bus to paya lebar

Lastly, The Continuum which was my favourite. But let me go through why people frown

upon it.

- Price: it can’t be cheap not only because of the freehold tag but

the fact that they had to demolish the existing units and rebuilt.

- View: Given my budget, I’ll most likely have a staring competition

with the residents living across my unit

- Accessibility: It’s not near MRT.

- Site layout: Both North and South Continuum are connected by ONE exposed overhead bridge.

- Morning congestion for drivers as everyone is trying to leave for

work.

Reasons

I like it:

- Direct bus from my house.

- The beauty of not staying too deep into Tanjong Katong Road

is that the haig road market is accessible, and you can easily cycle to MRT

- The crowd from Paya Lebar MRT will not spill over to this area

keeping it quiet and peaceful

- There are 3 buses to bring you to Paya Lebar MRT and their

frequency is quite high, I’m sad they removed Bus 76 but we now have Bus 134

so….

- Bus 30 also brings me to Dakota MRT

- There are a lot of hidden gems in Joo Chiat/Haig Road/ Katong all within

walking distance.

The

Bridge is a double-edged sword. Developers tell you it’s connected but they don’t

really want residents to use each other’s facilities too regularly.

I

also found out that the bridge was a 99yr leasehold which they had to acquire from

govt, so it made sense to keep costs low with the option of separating the

development later.

That also explained why there didn’t build more bridges or connected the underground

carpark. However, there is no excuse not to have a covered bridge

Looking

at the reviews so far, everyone seems fixated that the proximity to MRT is

deal-breaker. This is good news for me.

Other

considerations were that this is a 3-way fight.

Since

the cream of the crop is Grand Dunman which is only launching later, everyone

has to store their ammo and circle back to The Continuum later.

This

increases my balloting chances which is extremely important as I’m on an

extremely tight budget, I don’t really have many options.

For

a more in-depth review of The Continuum, you can check out here

Another

thing you might have noticed, I didn’t mention anything about profit. I am not

good enough to analyse and it really isn’t the priority here.

Preparing for the purchase.

So

the first question was affordability, I started looking at options in Nov 2022.

I budgeted for a limit of 1.4 million and was only looking for a 1 Bedroom

unit.

Fast forward to 2023, when I was doing a bazi review. I was advised not to buy

a property and get it only when I need it. The other piece of advice was that if I really had to do it, I needed to trust

the experts to guide me. Since

housing is a good-to-have, I planned my finances as though I wasn’t buying a

house. This created a lot of problems later.

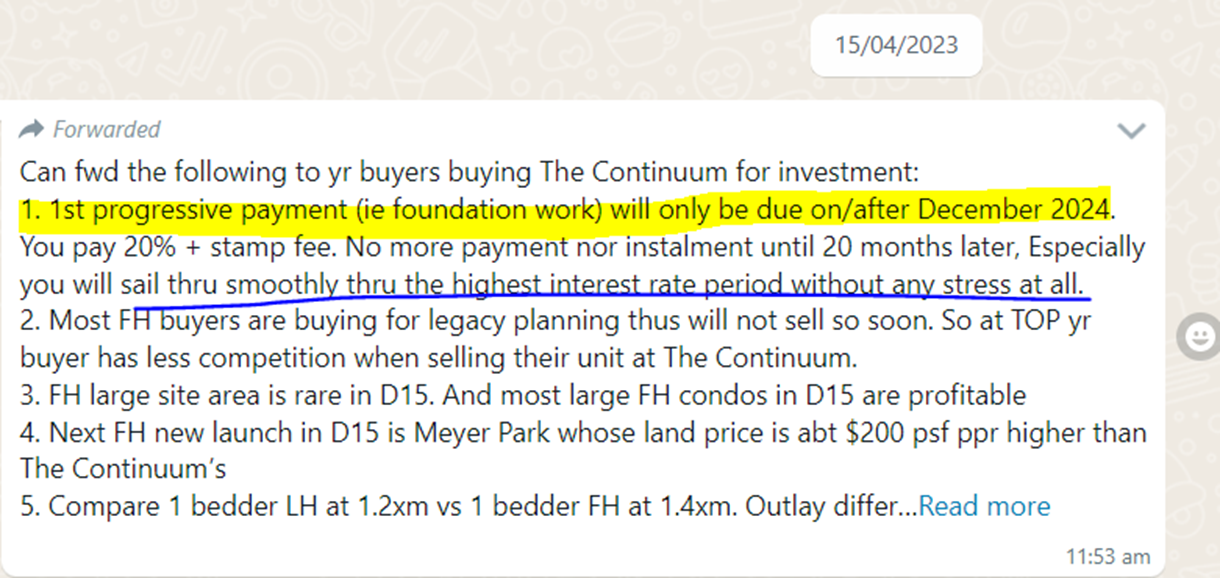

When the continuum’s price was announced, a 1 bedroom was around 1.48 million and a 2 bedroom was 1.68 million. I totally gave up the idea until this fateful message:

This

meant that I had time to save for the last 5% until December 2024. My immediate

hurdle was 20% + stamp duty,

This means that the first 20% + BSD is only due in the first 8 weeks from the purchase.

There are rules to follow for the 25% downpayment:

- Cash must be exhausted first followed by CPF

- If you are using CPF for the 15% milestone, the last 5% due later will be earmarked in your CPF account. i.e. CPF Balance - 5% = amount available to pay for 15%

- This will not be an issue if you are paying the first 20% with Cash.

I also agreed that I needed time to sail through

the “high” interest rate environment.

So it was back to the spreadsheets and gathering feedback. I was challenged multiple times:

- Renting a freehold gives terrible yield.

- Housing proximity to MRT is too far

- Most people flip properties and 1 Bedroom is hard to sell

- Whether I had the best property agent helping me was he trying to

oversell me? How about a second opinion?

- Is my loan agent good? Everyone has someone else to refer

- At this price, there are many other ready developments I can buy, WHY D15.

- Freehold tag is oversold, no one values freehold anymore

- The new units are too small.

- Did I factor in all the possible payments?

- Does this place have the right fengshui that harmonises with my

Bazi

- Is the developer hiding information? where are the demerits

located in the estate? What are they withholding?

- Did I get blessings from Guan Yin temple?

These

were all really helpful as I really couldn’t see some of them, it also helped

me ask the right questions and filter which units I should filter for.

Personally, the toughest part was getting the blessings from Guan Yin temple its beyond my control. It felt like going for a sorting hat. I was worried for days and was really glad that it turned out well and it reassured everyone.

On

viewing day, my friends came down to view the show flats and there weren’t many

objections. I actually chose an auspicious day and hour to visit which was great as there were hiccups with the registration. We were able to resolve it at a go due to this arrangement.

During the Feng Shui review, I had 3 floorplans to prioritize. Interestingly the unit I loved the most wasn’t suitable and booted. This reduced 1/3 of the units in my list to 20 units, with 6 being the most important… even Level 1 was fine.

On balloting day, I was blessed with the No. 28 out of 540 which was a clear sign that there will be something for me. Obviously, it’s because there were only 540 cheques. However, that is precisely why I had a fighting chance.

People were eyeing Grand Dunman or even Reserve Residences.

With this in mind, the next thing I did (or should have done earlier) was to make sure my future cashflows are in order.

As

you can see, I’m not planning to make money from renting and the real shit comes

in when the interest rates hit 6%.

On booking day, only 1 unit on my list was sold during pre-sale and my first choice was available. It was also great that they had the pricelist ready and I could see the prices of the 6 units in my shortlist.

The

booking started at 10 am and I confirmed the unit at 10.11 am. Even my loan agent couldn't believe that we were all done.

When the stars align

This

is going to be the most pan tang section of the article. After 16 years of

education and 10+ years of working experience, this is how I turned out :D.

As

mentioned earlier, there were already signs in my Bazi chart that I might buy an

asset or take a loan in 2023. The key requirement was that I will be unable to

pull it off alone and needed assistance from benefactors.

Sequent of events:

- This area has had a lack of Condo for many years and they are 3 that were launching in 2023 making everyone spoilt for choice.

- The Freehold project was closest to my circle of competence.

- The order of launch was in my favour as people already bought Tembusu

Grand or were holding back for Grand Dunman.

- Closer to The Continuum’s launch, there were clamped down on ABSD

evaders and cooling measures for foreign buyers

- I managed to apply for the loan in the most efficient way and was

able to get a good loan offer.

- There was also a nagging feeling that I might have issues taking a

loan later.

- Funding the downpayment + BSD was also a challenge but I already did

my homework.

- I was also given 18 months to save for the last 5% of the downpayment.

- My friends helped immensely throughout this entire process and I am eternally

grateful to them. For example, stretching me to buy the popular 2Bedroom

instead of 1Bedroom which only sold 3 units.

- The Fengshui guidance coincidentally led me to the cheapest units

in the development.

- I’ve also attained the blessing from the temple and was

blessed with the best ballot number that I could ever ask for.

- Post buying, I realised that I managed to secure a good unit at below

average selling price.

- It was also funny that I only found the forum discussions on the continuum post-buying so that I wouldn’t get confused by keyboard warriors.

These

were all done and dusted within 3 weeks.

Subsequently, HDB announced the extension of the income assessment period for HDB applicants from 6 to 12 months. That cancelled the fallback plan that I had in mind.

Bonus: I went back to the show flat on 12 May 23 and took a picture of the current sales

Please like and follow us: